A group of State University of New York (SUNY) employees want their retirement fund to pull their investments from industries and companies that are damaging the environment and contributing to climate change.

Stony Brook University’s Senate, United University Professions and six other New York higher education institutions have passed resolutions over the past few months supporting the effort to make SUNY’s primary retirement equity-fund company, Teachers Insurance and Annuity Association (TIAA), divest $8.42 billion of their investments in fossil fuels and invest the sum into renewable energy.

With scientists warning of a growing climate crisis, large businesses and governments have promised to divest as part of their climate plans. New York state has committed to divesting from fossil fuels into clean energy as part of 2019’s Climate Leadership and Community Protection Act; the state’s Common Retirement Fund divested $7 million from oil sand firms on April 12.

Advocates said the goal is to pass resolutions at as many universities as possible and pass a SUNY-wide resolution to encourage the SUNY Chancellor and Board of Trustees to take action.

“I tried to get the attention of as many people [at Stony Brook] as I could and found that so many people were interested,” Justin Johnston, an associate professor of English at Stony Brook said. Johnston sponsored the resolution in Stony Brook’s University Senate, which passed with 81% of the governing body’s vote.

Johnston’s resolution was drafted with the help of TIAA Divest, an organization made up of environmental advocates and academics who condemn TIAA’s investments in fossil fuels and companies participating in deforestation.

According to Chain Reaction Research, who review the behaviors of companies and their link to deforestation, companies which TIAA has invested in have been implicated in land grabbing and deforestation of farmland in Brazil.

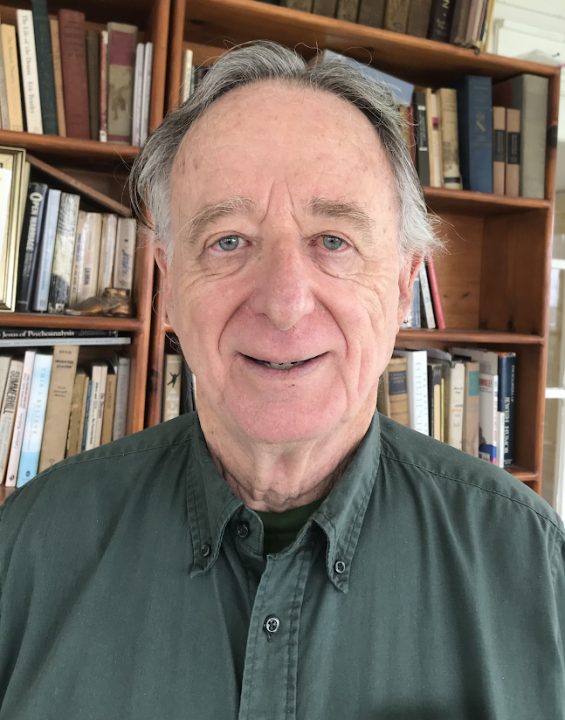

SUNY New Paltz Sociology Professor Brian Obach has been involved with TIAA Divest since last November, and was the sponsor of the first resolution passed in the state. He said he’s been receiving more and more requests to help bring proposals to universities in New York, a sign that their movement is gaining traction.

According to the investment search platform Fossil Free Funds, TIAA has invested $8.42 billion in the fossil fuel industry. They are also an investor for Cricket Valley Energy Center — who uses fracked natural gas to create electrical energy. Hydraulic fracturing, or fracking, is a process of extracting natural gases and fossil fuels from the ground, and also contributes to air and drinking water pollution.

According to a statement from TIAA last September, when the company invested in Cricket Valley in 2014, they were supporting natural gas as “bridge fuel” to more renewable energy. They said that they have explored the idea of selling their stake of Cricket Valley, but deals for their investment have not been fruitful enough to benefit their customers.

“Sustainability is integral to our investment process and success on behalf of retirement savers and is aligned with our commitment to reduce the impact of climate change,” a TIAA spokesperson said to The Statesman.

Although fossil fuels may make up only about 5.5% of TIAA’s investment, that hasn’t stopped TIAA Divest from criticizing the company, and introducing and passing resolutions across the state.

“TIAA’s relationship with the climate crisis, I would say, is not trivial,” Johnston said. “I think that this at least brings together some stakeholders, gets us in communication, hopefully generates energy and galvanizes us in the future to have even more difficult questions — questions about inequality and environmental justice.”

TIAA’s Divest’s co-organizer and environmental activist Iris Marie Bloom said she created the organization after she discovered TIAA’s investment in Cricket Valley during a demonstration against the power plant’s construction.

“Our goal is of course to protect the climate, but we are also working on social justice, indigionous rights and fighting environmental racism in very specific ways by targeting investment that TIAA is funding right now,” Bloom said.

Bloom is referring to TIAA investments in companies such as the Adani Group, a coal energy company that is currently in a legal battle to build a mine on Australian indigenous land, prompting a #StopAdani protesting movement. TIAA is also an investor in Enbridge, a Canadian energy company who are currently in the process of building the Line 3 pipeline — which would carry heavily polluting oil sands — through Anishinaabe indigenous land.

“It’s really kind of disappointing and surprising that TIAA has not gotten on board with this — has not seen the writing on the wall that this is going to happen,” Obach said. “It is imperative that they get out in front and divest immediately.”

Susan Van Dolsen • Apr 23, 2021 at 2:14 pm

Excellent article and great work by Justin Johnston and the Stony Brook Faculty Senate. We have our pension with TIAA and we feel that the company must sell or get out of their ownership share of the Cricket Valley fracked gas power plant, return the land to Brazilian farmers that was illegally taken from them, stop investing in fossil fuels and deforestation-risk holdings, and halt the land grabs all over the world that have had negative impacts on BIPOC communities. For a company that prides itself on social responsibility, the practices are perpetuating an extractive economy.

Alex Crawford • Apr 23, 2021 at 12:58 pm

Thank you to Stony Brook University for your leadership in passing a Faculty Senate Resolution and for demonstrating the impacts of TIAA’s action on the environment and on indigenous communities in this article. I am optimistic that more universities and campus leaders will continue to pass resolutions and stand up to TIAA. As a SUNY Student, it is inspiring to see campuses stand up for climate justice!

Britten Evans • Apr 23, 2021 at 11:58 am

TIAA has so long to go to live up to its brand image of a “responsible investor.” I’m so glad SUNY faculty and staff are taking a stand demanding divestment from fossil fuels and deforestation. It’s an environmental issue, and a human rights issue.