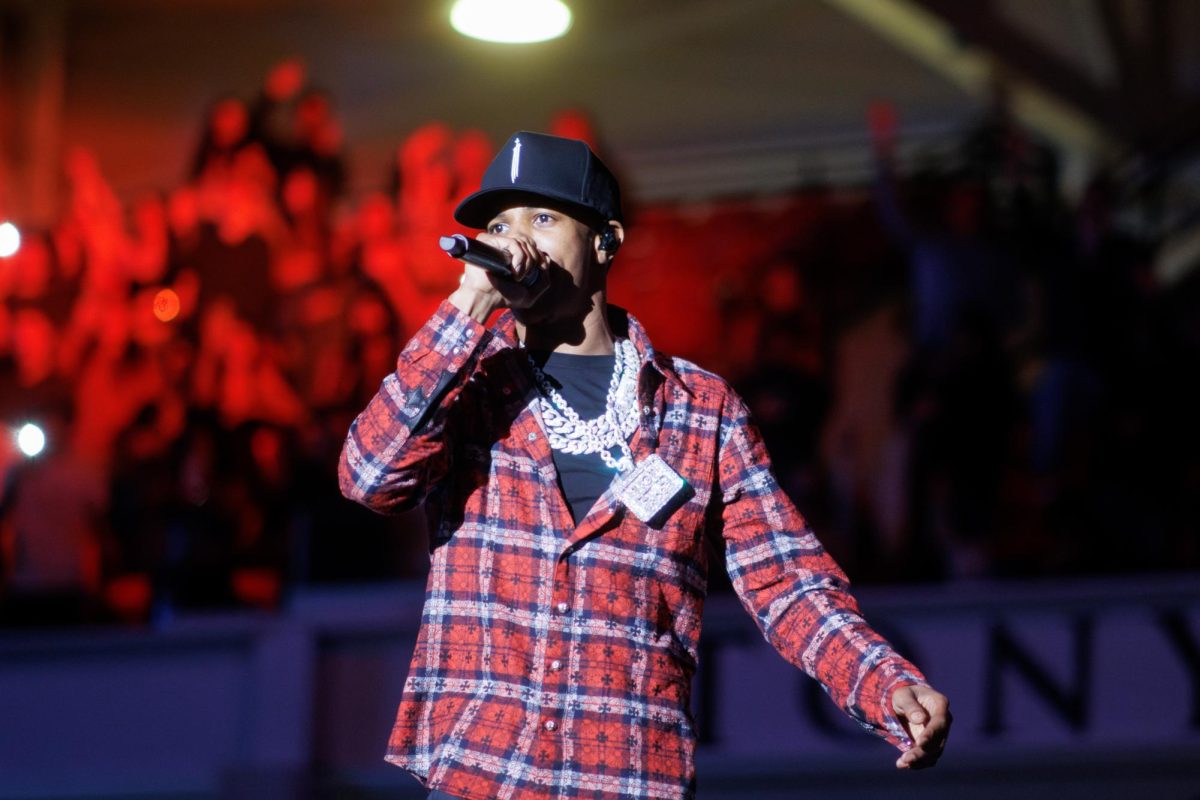

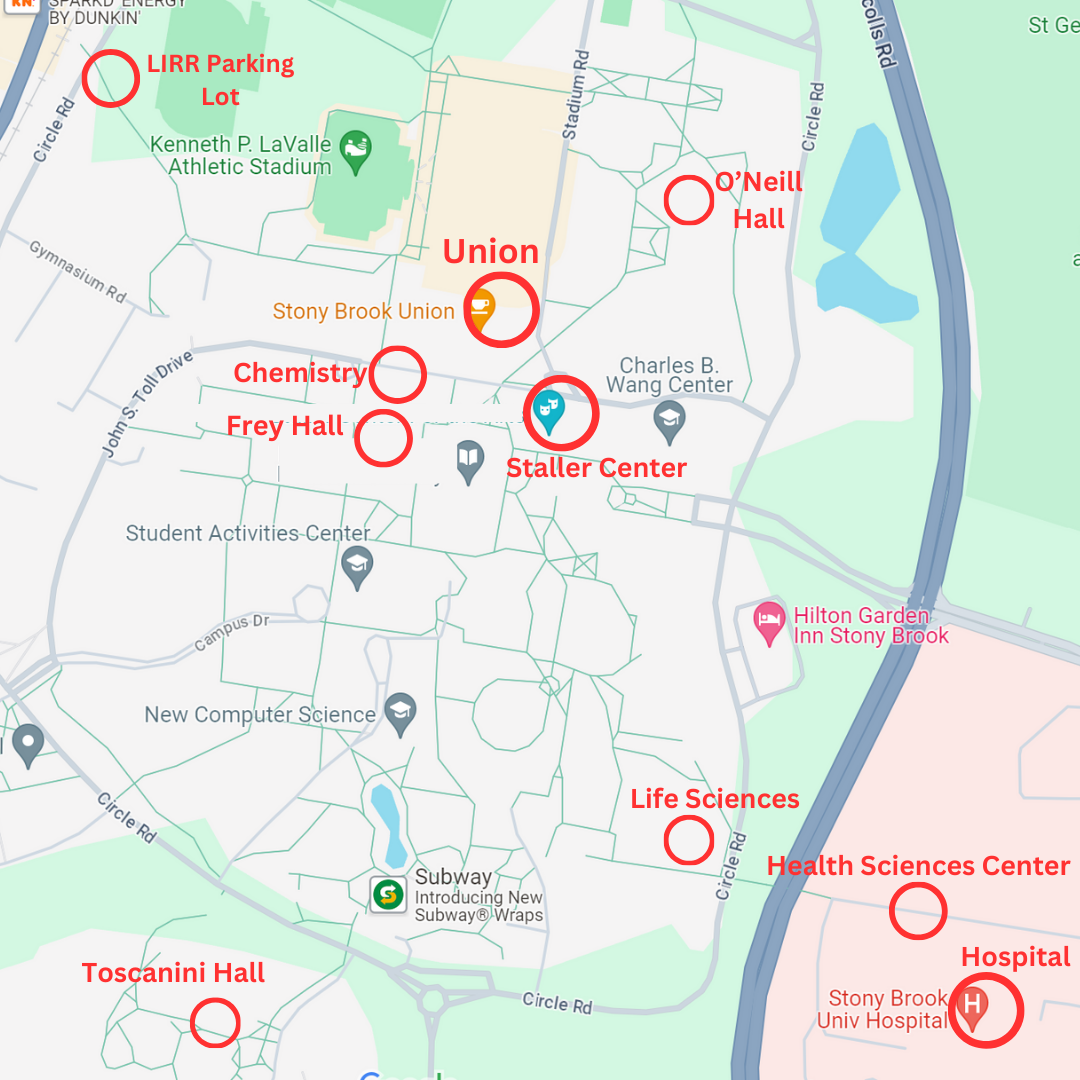

Stony Brook economics and public policy professor Stephanie Kelton discussed how the political debate surrounding the United States national debt hinders policy making in the Staller Center for the Arts on Oct. 15. Her talk was the first of many in this year’s Presidential Lecture Series.

Kelton served as a chief democratic economist on the U.S Senate Budget Committee in 2015 before serving as a senior economic advisor to Senator Bernie Sanders’ presidential campaign. In her talk she argued that the national debt, the historical record of all the unpaid money borrowed by the federal government, is necessary for economic growth.

“We get bogged down over whose taxes should go up and by how much,” Kelton said. “There is an ideological framework that presupposes a concern over where that money is coming from and how the should government use it. Instead thinking of that as a problem, I want to shed a different light on it.”

She demonstrated how the debt works by taking out $10 and giving $4 to an audience member.

“I [was] taxed a total of $4, which leaves me with $6,” she said. “Normally that is recorded as a budget deficit, but what it really means is that $6 is deposited into the economy and allows the government to spend more.”

Currently, the U.S. national debt stands at around $21 trillion and counting, according to the U.S. National Debt Clock.

Kelton described the debate over the national debt as a “bipartisan chorus,” since both parties in Washington believe that having such a high debt will produce dangerous economic consequences for future generations. But disagreements over what to cut from the budget creates an endless cycle of finger-pointing, she said. “Both parties blame each other over who’s responsible for driving up the debt,” Kelton said. “They will tell you that it is a disaster for the nation. This idea that the ‘sky is falling’ does not paint the entire picture.”

Democrats argue that the Republicans’ recent tax cuts have contributed to the deficit while Republicans pin entitlement programs as the real culprit. In Kelton’s eyes, both parties have overlooked the benefits of having a deficit. “The national debt is an important factor that helps secure U.S. treasuries that investors like to keep in their portfolios,” she said. “The private sector–that is all American households and businesses–benefit from it.”

Kelton said she believes deficits can easily become surpluses and therefore should not be feared. When the government creates deficits, the private sector gains the surpluses, which are regarded as “assets” for the economy to thrive.

Referring back to the $10 she started off with, Kelton explained, “although the government recorded minus $6, someone else in the economy will collect plus $6.”

Yet the question “How will you pay for it?” she said, makes the national debt an obstacle to passing legislation, mostly for fear of adding to that deficit.

“It isn’t a concern about its merit or why it should be addressed, which is why we don’t end up having real conversations” about policies that matter, she said.

According to The New York Times, the budget deficit for the 2018 fiscal year was $779 billion, the largest since 2012.

This past June, the Congressional Budget Office projected that by the end of the next decade the national debt could reach the equivalent of 100 percent of the country’s Gross Domestic Product (GDP.)

With higher entitlement spending toward programs such as Social Security and Medicare projected to increase as well, Democrats and Republicans have different attitudes toward how much to spend.

“We have demographic changes in this country that are placing the labor force into retirement every year,” Kelton said. “The people that are left are producing less, but that doesn’t mean the [retirees] won’t stop consuming.”

Referring to the response that Alan Greenspan, Former Chairman of the Federal Reserve gave regarding this issue, she added, “Greenspan is saying ‘How do you protect these assets — the production — until it is time to hand out those benefits for the retirees to spend money in a productive economy without running into inflation?’”

Kelton pointed out, however, that completely paying off the national debt would also have negative consequences because it would prevent the federal government from selling bonds. Since bonds are essentially loans paid for by the public that provide spending money for the government, the economy can remain afloat — the more bonds sold, the more Congress can spend.

Kelton stressed the importance of utilizing resources that can fund policies before turning to money. “If we need a trillion dollars for infrastructure, instead of asking how much money you need to pay for it, say that you’ll need 300,000 construction workers, steel, and factories to manufacture those products. Unless you have the economy at its full capacity, then you can say that you can’t afford it.”

Kelton emphasized that people should not be alarmed by the national debt, as it is not always an indicator of the economy. She said that the last time the national debt was balanced, in 2001, a recession hit later that year.

“Whenever revenue is raised, we tend to think that the government must be broke if they are increasing taxes,” Kelton said. “That is not true, because the United States is a scorekeeper for the dollar. We can never run out of numbers to measure the debt as it increases. As long as we continue to use the dollar, the federal government will never go broke.”