The federal government signed a $2.2 trillion relief package into law on March 27 that will provide higher education with $14.25 billion in aid, and suspend payment and interest for federal student loans.

Most of the funds for Coronavirus Aid, Relief and Economic Security (CARES) Act focus on relief for businesses, unemployment insurance programs, the health care system and individual Americans impacted by coronavirus (COVID-19).

Adults who make under $75,000, or $150,000 in the case of a joint income, will receive a $1,200 relief check, with an additional $500 for every child under 17 years old filed as a dependent.

College students, many of whom are over 18 years old and are claimed as dependents by their parents, are less likely to be eligible to receive the $1,200. Even if students are claimed as dependents, anyone over 17 does not qualify to grant their parents the additional $500.

According to Pew Research Center, younger workers are disproportionately affected by COVID-19 business disruptions. Younger workers make up 24% of employment in high-risk industries overall, with nearly half of workers ages 16-24 employed in service industry jobs depended on customer interaction.

Full-time college students are generally not eligible for unemployment. To qualify, applicants must have been paid for work in at least two calendar quarters and paid a minimum of $2,400 in one of those quarters.

A student who lost their job because of the coronavirus epidemic, however, may qualify for unemployment under the CARES Act.

The new pandemic guidelines extends protection to individuals who were working in places shut down because of COVID-19; individuals who can’t work because they’re caring for individuals diagnosed with COVID-19 or have been diagnosed themselves; and people who were supposed to start new jobs but can’t because of COVID-19.

The act also includes $30.75 billion to help higher, elementary and secondary education.

The bill is suspending payment and interest for federal student loans through September 30; the suspension does not affect private education loans or other specific federal loans such as the Federal Family Education Loan program, which ended in 2010.

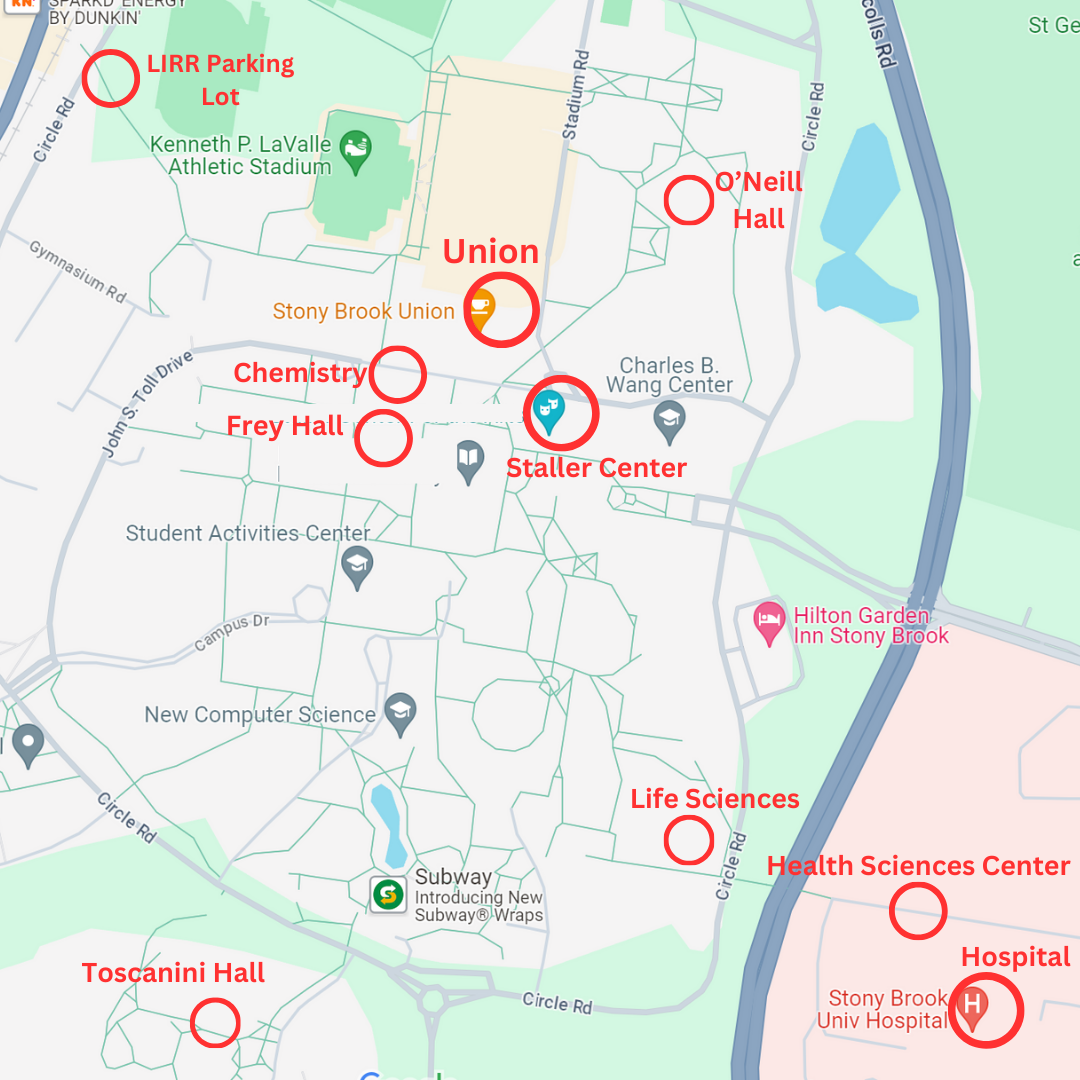

The Higher Education Emergency Relief Fund of $14.25 billion is directed towards higher education institutions to “prevent, prepare for, and respond to coronavirus.” Institutions that are hit heaviest by COVID-19 will receive more from the fund’s stipend.

The relief is distributed among colleges according to student enrollment. Institutions with full-time Pell Grant recipients will receive more funding from the bill. Students enrolled exclusively in distance education courses before the law was enacted will not be included in calculations for university funding.

State governors were also directed to share $3 billion, allocated according to state student population, for local education agencies — including school districts — and higher education institutions most significantly impacted by COVID-19.

The CARES Act waives certain restrictions and requirements on a higher education institution’s access to unexpended federal funding, allowing them to use the money to relieve unexpected expenses brought onto students and themselves by COVID-19.

Federally funded students who might be required to withdraw from an institution during the duration of the COVID-19 emergency are waived from the obligation to return federal financial aid funds and repay loans.

Students during the COVID-19 emergency will be allowed to take leaves-of-absences without making up for the lost time, as long as they resume their studies in the same semester. If a student can’t complete academic credits for reasons related to COVID-19, institutions are obligated to exclude those credits from calculations for federal aid.

The Education Stabilization Fund protects employment for workers at schools and universities and requires that they’re paid for the duration of the COVID-19 disruption “to the greatest extent practicable.” This includes higher education work study students, who are to be paid with unused federal work study funds in the form of grants.