The average Stony Brook University (SBU) student with loans graduates with about $19,000 in student debt, according to the Financial Aid Office, affecting social and academic life during their undergraduate career.

These enormous costs hit first-generation and low-income students the hardest. Two-thirds of first-generation students owe over $25,000 in loans, according to Pew Research and 87% of people who default on loans also receive Pell Grants, meaning a borrower’s family income is below $50,000 a year, according to the Center for American Progress.

“[Student debt] kind of pushed me a little harder to make my four years count,” Shazim Hassan, a senior mechanical engineering major, said. “I spent hours upon hours applying for internships every year, ever since freshman year. I’m looking for on-campus opportunities as well and part-time opportunities wherever possible.”

Student debt has some impacts on post-graduation life as well. According to the National Association of Realtors, 33% of graduates with loans have delayed continuing education and 29% said loans affected their decision to buy a home. These loans could also lower students’ net worth and credit scores and disqualify students for potential jobs.

On top of these financial implications, there are also the looming psychological effects that debt has on students’ mental health. Many students experience profound stress, anxiety and feelings related to shame when thinking about their financial situations related to school. In a 2021 survey, one in 14 student borrowers said they experienced suicidal ideation because of taxing debt situations.

“It is definitely scary to think about and look at the numbers sometimes,” Jessica Gibson, a junior human evolutionary and biology major, said. “Because of my financial situation, I find it a necessity to go to work sometimes. This creates a lot of stress for me because it’s challenging to balance school and extracurriculars with work, [and] sometimes I worry I do not have enough fun or happiness in my life.”

This effect is tenfold for first-generation students, like Hassan and Gibson. Their families, like many others, felt unprepared and struggled to adjust to the high costs of education, as well as the amount of student debt that can accumulate.

“I’d say definitely there was an initial adaptation issue,” Hassan said. “But we sort of consulted on how we can take federal loans to sort of ease the burden of paying for college.”

Gibson said that her parents felt the same way.

“My parents [were] definitely surprised by how expensive college is,” Gibson said. “They did not realize that tuition and housing would be as expensive as it is.”

When the pandemic hit in 2020, students found that their debt became even harder to maintain, with the national unemployment rate reaching 13% in April 2020. According to credit bureau Experian, the average student loan debt increased by 9% in 2020, because of payment deferrals during the COVID-19 pandemic. With families losing jobs and their primary source of income, many students find it even harder to manage loans and pay for their college education.

“The pandemic caused my father to lose a lot of money because of a lack of jobs,” Gibson said. “This has caused stress on me as well as my father is struggling financially and cannot help me out with as many expenses as he used to be.”

To relieve students’ financial pressure during the pandemic, SBU worked to aid students in various ways, with the biggest contribution of support coming as the Higher Education Emergency Relief Fund (HEERF). The grant-based program is aimed at providing emergency aid to college students who are struggling financially because of the COVID-19 crisis. The HEERF has awarded nearly 19,000 unique students so far, with $32.9 million in rewards, about $1,700 per student.

The first two rounds of the program came in 2020 as the CARES Act Fund and the Higher Education Relief Fund, each awarded $9.8 million in grants. American Rescue Plan was the latest round of funds released in September 2021, which aided students with about $27 million in grants.

“Primarily, we’ve tried to use a matrix index to identify what a student’s need level is, and then try to give them an automatic reward associated with that,” Nicholas Prewett, the director of Financial Aid and Scholarship Services at Stony Brook, said. “We could always use additional need-based grant funds to give out to students and that’s one thing that we advocate for as an institution, either at the state or the national level. We’d love to see additional help go to students to help really offset the cost of college.”

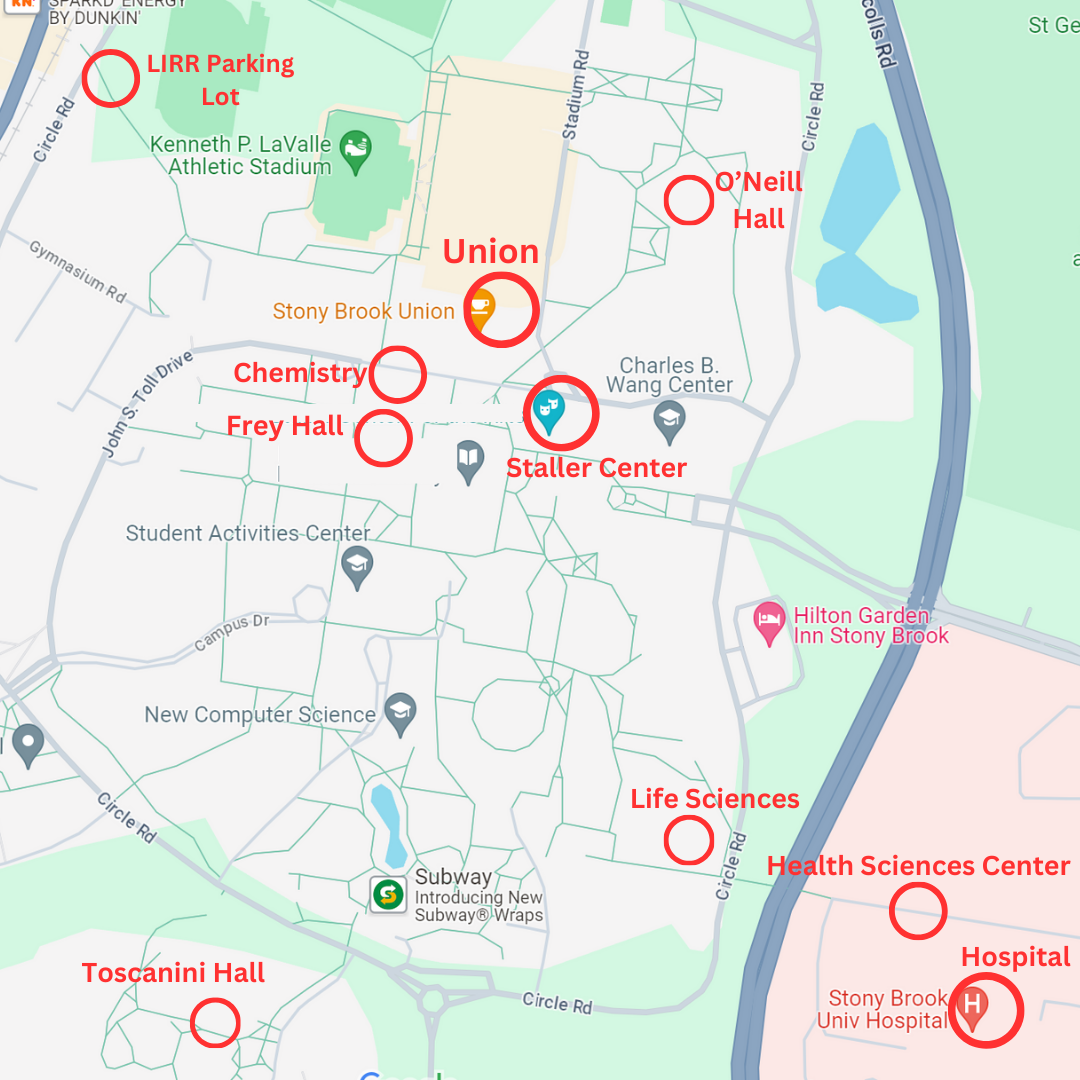

For students struggling with debt, SBU offers support in different areas to ensure that students can manage their loans in reasonable ways, including outreach programs and workshops on campus for students to learn how to cut down on costs

One specific program that SBU’s financial aid office provides is Money Smart Seawolf. It is an online tool that helps students and staff learn about ways to finance their money and make smart investment choices. Its goal is to teach the SBU community about the proper skills needed to make important financial decisions they may run into in the future.

Gibson has never used the program, but said it “could be helpful if they gave students information about scholarships, grants, and how to apply for aid.”

The program covers a range of topics, from budgeting to the basics of banking, with overviews on how students can navigate each specific financial area. There is a comprehensive list of third-party resources for additional information, and advisors also offer one-on-one workshops to help educate students on financial literacy upon request.

“One kind of general rule of thumb that we always tell students is, don’t borrow more than the total student loans that you’re going to earn [in] your first year after you graduate,” Prewett said. “It’s better to live like a college student when you’re a college student than to live like a college student when you’re a graduate.”