“Living with my parents will allow me to save a substantial amount of money because rent in New York City is extremely expensive and finding a roommate is too much of a hassle,” graduating senior Melody Peña said.

College graduates often find themselves moving back home after college, but financial experts are advising them to follow a strict budget to be able to move out faster.

Sixty-five percent of parents expect to support their children for up to five years after graduation, according to a study from Upromise by Sallie Mae last year.

“I plan on moving back home,” Peña said. “My parents live in Brooklyn, and I accepted a full time position which is easily accessible from my parents’ house.”

The survey also said 68 percent of students expect their parents to help them in their post-grad lives.

Experts around Long Island, including financial advisors, all suggest sticking to a strict budget and avoiding superfluous spending.

“They must understand their budget, stick to their budget, and make time to pay their bills,” said Theodore Agrillo, founder of Agrillo Financial Group based in East Meadow, New York. “Splurging on something or going out to the bar and spending $15 on a drink isn’t going to get you out of your parents basement.”

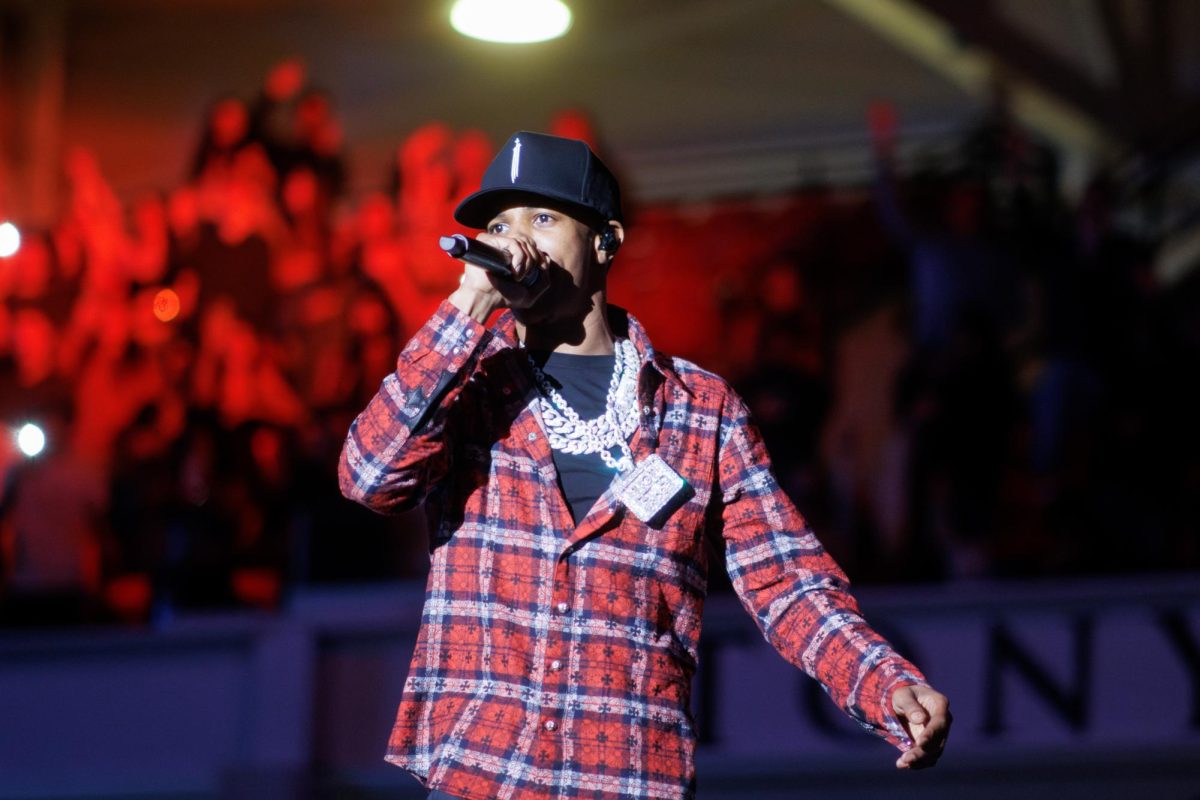

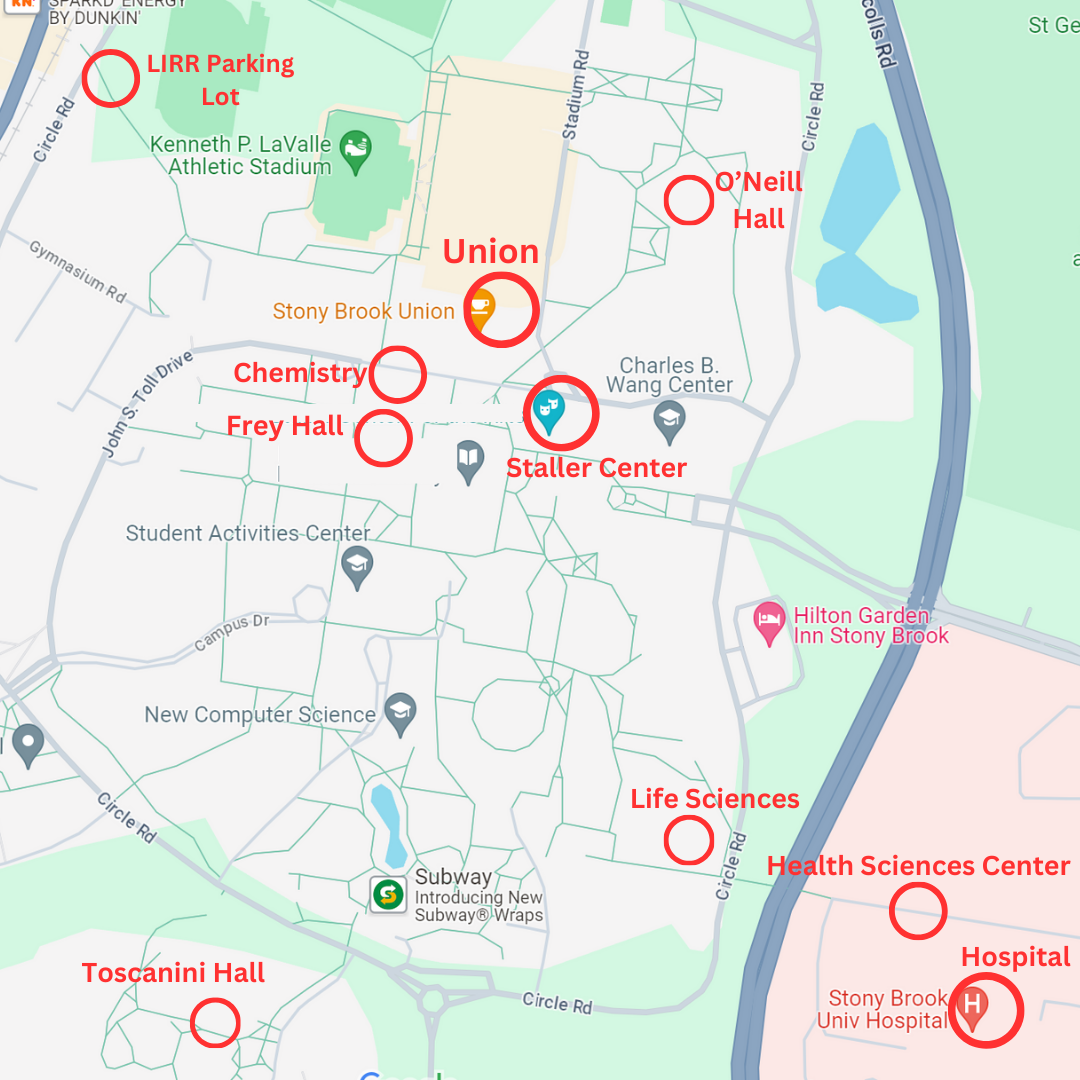

Renee Pelletier, senior financial aid advisor in the Career Center at Stony Brook University, advises students to plan ahead.

“If they know in six months they’ll begin paying back student loans, they have to figure out how much is left over to determine what they can afford,” Pelletier said in an email.

Here are some tips compiled by experts:

- Stay on Budget

All experts interviewed said the most important thing was planning a budget and sticking strictly to it. It is important to know when student loan payments have to start getting paid off, along with other expenses like car insurance and phone bills.

“It is not a good idea to put yourself in a position where basically every incoming dollar is already accounted for with an outgoing expense,” Pelletiere said. “If that happens, there is no wiggle room for ‘when things pop up’ or even putting money aside for savings.”

To learn more about how to plan a budget, visit the Stony Brook University Office of Financial Aid and Scholarship Services website.

- Take a job, even if it isn’t your dream job

Financial expert Rachel Ramsey Cruze said that recent graduates have to take jobs, even if the jobs aren’t where they thought they would end up after college. Taking a job waiting tables or as a clerk in a department store can help with saving money and gaining experience to get the job you really want later on.

“It’s important to have realistic expectations,” Cruze said. “You’re in your 20s, not your 50s, so don’t expect to have your parents’ lifestyle immediately after graduation.”

- Make safe investments

Agrillo said that instead of investing in stocks, which can be risky, millennials should consider investing in some mutual funds or bonds. Although these take longer to pay off, they are much more stable than buying stock.

Pelletier said that with a budget, investing can be very beneficial, but only if the person has enough funds to do so. She also said investing while young can be great because compound interest over the years can earn them a lot of money.

- Cut costs

Students who are trying to move out of their parents’ house might consider getting a roommate to split the cost of rent. Getting a roommate is not the only way to make ends meet. Experts say that little things like reducing phone bills and avoiding eating out can greatly reduce the amount of extra spending millennials do. Learning to cook can also reduce spending because it is much cheaper to cook your own meals than to eat out several times a week.

“If you choose to set $100 aside in a month to put towards savings instead of spending on an evening of dinner and drinks, that’s a good thing,” Pelletier said.