The mother always answered her daughter’s repeated requests to buy something extravagant with the same two unyielding words:

“College fund.”

Her daughter snapped back with her own two words: “Nursing home.”

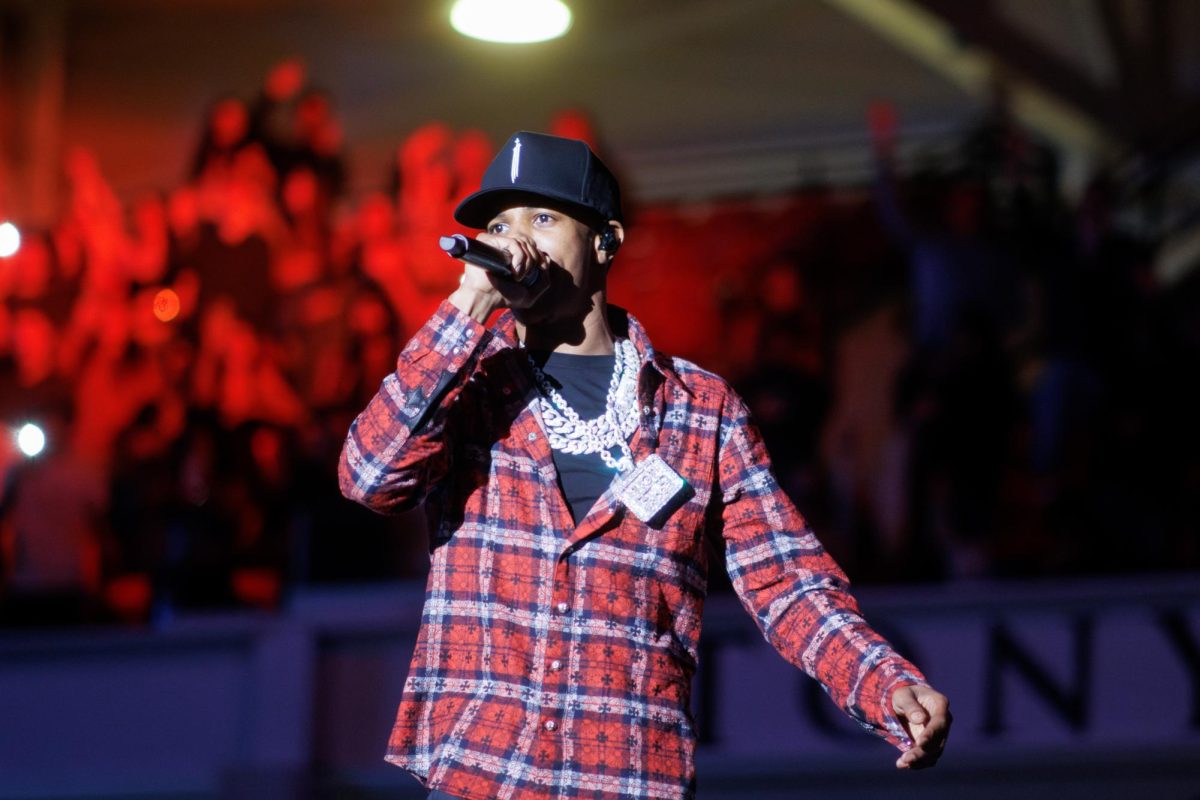

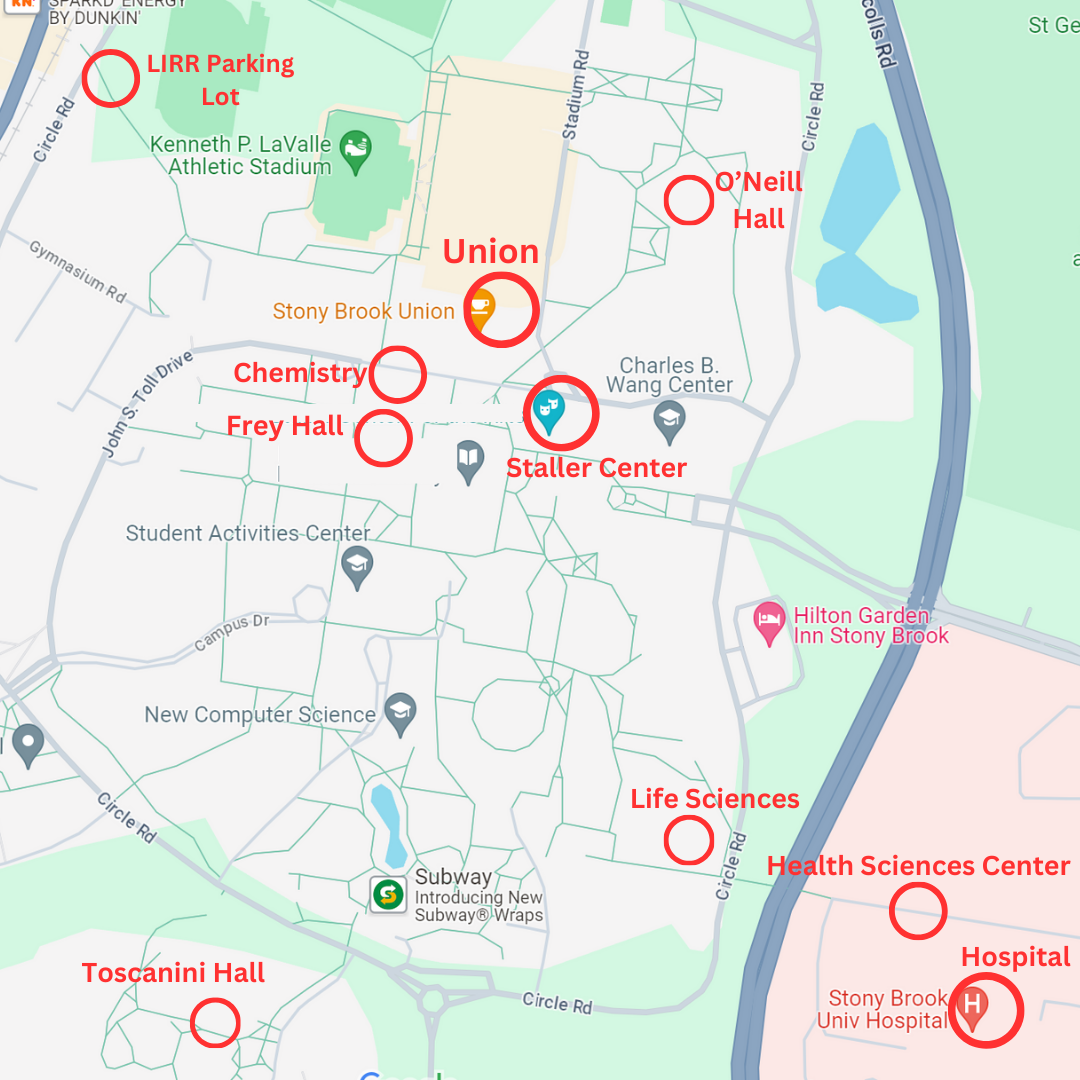

Michelle Singletary, the mother, laughed with the audience as she recounted the story during a discussion about families dealing with personal finances, such as student loans and saving for retirement, at the Charles B. Wang Center theater Thursday night.

The discussion, “Family Matters,” was presented by NPR in collaboration with its Long Island affiliate WPPB. The discussion was led by Singletary, a nationally syndicated personal finance columnist for the Washington Post, and Louis Barajas, the founder and chief wealth and business manager at LAB Financial Life Solutions.

Despite their opposing approaches to personal finance, both experts stress communication within families and prioritizing budgets. The crowd of mostly middle-aged adults sprinkled with some students was engaged all night with Singletary’s bluntness and Barajas’s empathy.

Along with the NPR’s two co-hosts, David Greene and Sonari Glinton, the crowd laughed during the unconventional panel-audience discussion that made the harrowing topic of financial woes a little less frightening.

Fielding financial questions from the audience, Singletary and Barajas had different approaches on how to manage personal finance.

Singletary took a radical and hard-line approach.

An unsuspecting couple sitting in the front row found out how strict the finance expert could be.

“Which scissors should I use?” Singletary said as she pulled out scissors to cut the couple’s credit card after they told her their outstanding credit card debt. Singletary drew laughter when she walked near the front of the stage and continually teased the couple with the scissors, “C’mon. Cut it up. C’mon.”

The couple’s inability to cut up the card is a look into an underlying problem, Singletary said. She said that she believed families and students should prioritize eliminating all outstanding debts before worrying about any other finances and expenditures.

Barajas took a more subdued and balanced approach, saying that it is OK to prioritize things that are important to you, such as investing in family values and date nights, over outstanding debt so long as you still pay, but maybe not as fast as Singletary would like.

“I want to make sure my clients are investing on spending on memories, experiences and at the same time putting money into their retirement and other things that are coming up faster than they think,” Barajas said.

Singletary agreed that making memories and having experiences are important, but she said that if debt is overwhelming, then it should take top priority.

“I want you to be in pain until you pay off that debt, so you don’t go out on date nights and you don’t go on vacation until you get that monkey off your back,” she said. “You know you can make memories without spending money.”

Barajas, a certified financial planner, said it is all about perspective and that each individual or family is different. In response to the couple’s credit card debt, which they attributed to many date nights among other things, Barajas said they have to ask themselves what values are important to them and prioritize their budgets accordingly.

“Go out to dinner every other week instead of every week, or save up for a family vacation every once a while, and put the rest in a retirement or college fund,” he said.

On choosing colleges and taking out student loans, Singletary and Barajas were more in agreement.

Singletary said families should choose schools that are the most cost-effective, even if it means the students have to sacrifice their dream of a traditional college experience. To her, that means “getting creative,” and going to community college for two years before transferring to a four-year university. Or, if families can afford it, the students can attend the more affordable state university instead of a prestigious university with a fat price tag.

Singletary explained that her daughter didn’t have a choice; they made her go to the University of Maryland, 17 miles from their home, because they could afford it.

“Ah! It’s too close!” her daughter complained.

“Really? If you walk, it’s not that close,” Singletary snapped back.

Singletary argued that you can get the same quality of education at a state university that you can at a prestigious university if you put in the work. She cited the fact that one of her co-workers at The Post went to Harvard and she went to the University of Maryland, but they both ended up at the same place.

“And I make more money than him now!” she said.

Barajas agreed that families should look for the most cost-efficient option, but he also believes “kids should have a skin in the game.” He agreed with Singletary that the parents should be in charge and “set some boundaries.”

He proposed the hypothetical example of California State University’s accounting program versus University of Southern California’s accounting program. Both are great programs, but Cal State tuition is $40,000 over four years, whereas USC costs $200,000. If the child insists on going to USC “because their friends are going there, that just doesn’t make sense,” he said.