New York Governor Andrew M. Cuomo’s plans to jumpstart the state economy are centered around SUNY campuses. And the university system could not be more elated.

On June 19, Cuomo, along with Senate Majority Coalition co-leaders Dean Skelos and Jeff Klein and Assembly Speaker Sheldon Silver unveiled their agreement to the legislation titled, “START-UP NY,” which stands for “SUNY Tax-free Areas to Revitalize and Transform Upstate NY.”

The economic initiative is designed to bring new businesses to the areas surrounding SUNY and other university campuses in the state of New York by creating “the opportunity to operate completely tax-free – including no income tax for employees, no sales, property or business tax – while also partnering with the world-class higher education institutions in the SUNY system,” according to the governor’s website.

“Tax-Free NY will put together all the positives of New York, the history, the geography, the diversity, the educated workforce and combine all we have to offer with a tax-free environment,” Cuomo said in a press release. “This proposal will make our state more competitive than ever before and supercharge our economic development efforts to rebuild Upstate New York.”

The bill states that companies participating in START-UP NY will be exempt from taxes such as business taxes, sales taxes and property taxes for 10 years and employees of participating companies will be exempt from income taxes for five years. It also says that for the next five years, “employees will pay no taxes on income up to $200,000 of wages for individuals, $250,000 for a head of household, and $300,000 for taxpayers filing a joint return.”

In order for a business to participate in START-UP NY, it must not only “be aligned with the academic mission of the campus, college or university,” but it must also display a positive economic effect on the community, which includes creating and maintaining new jobs.

Businesses are required to apply to the participating academic institution in order to establish their business and have until Dec. 21, 2020 to do so.

Excluded from the list of eligible businesses are retail and wholesale businesses, restaurants, doctors and dentists, law firms, financial services, accountants and utilities.

The bill also requires that any money the campus, college or university makes from a participating business must be used for “financial aid for students who are eligible to receive a tuition assistance award or supplemental tuition assistance … and to support additional full-time faculty positions.”

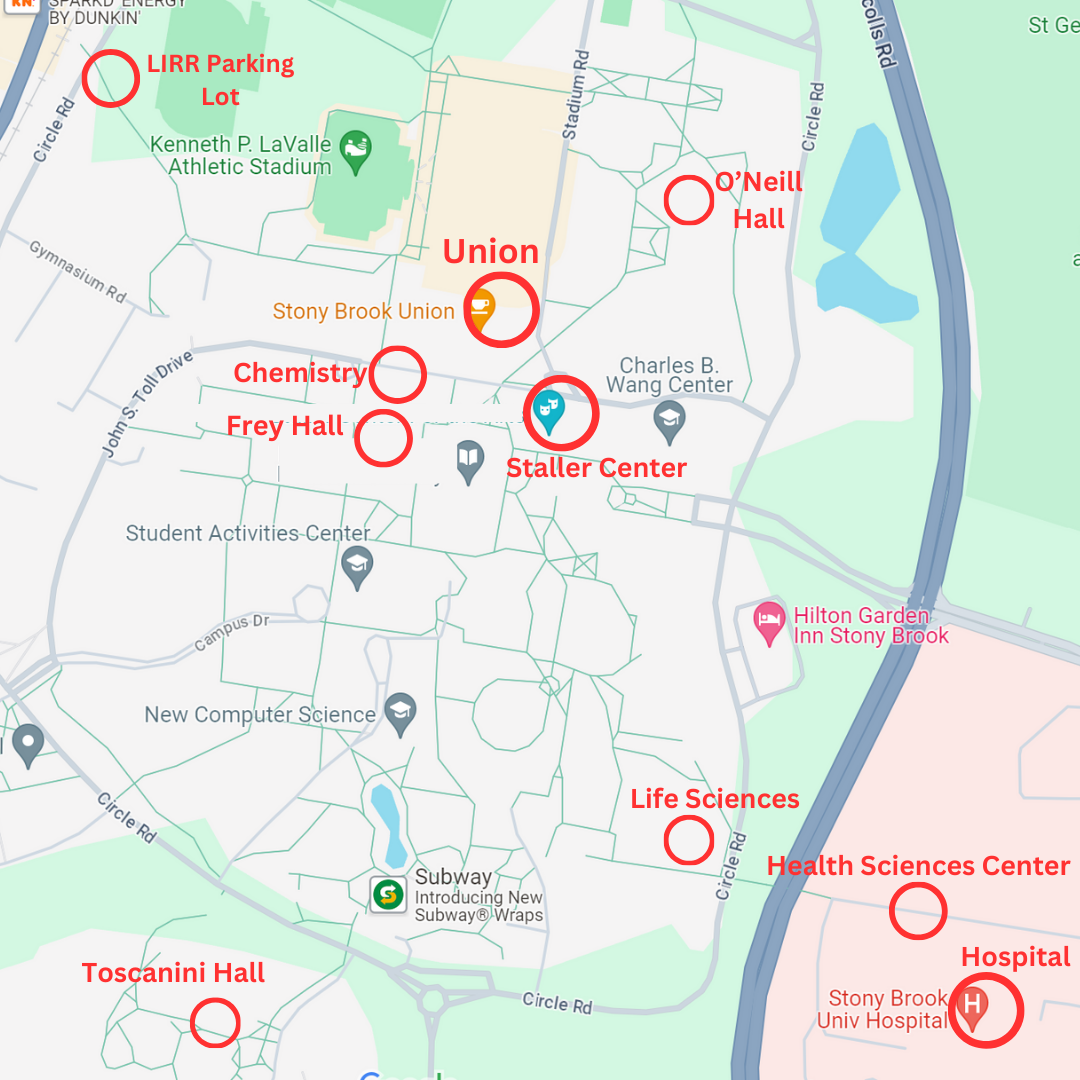

Stony Brook University President Samuel L. Stanley Jr. praised the governor’s ambitious plans at Cuomo’s Long Island “START-UP NY” bill signing.

“Stony Brook University stands ready to implement Governor Cuomo’s vision to create new business in the high technology areas and utilize our experience in advancing research into the marketplace,” Stanley said. “Years from now, New Yorkers will look back at START-UP NY as the game changer that returned New York’s competitive edge in the global marketplace.”

Stanley partnered with other presidents of colleges and universities on Long Island to pen an opinion piece in Newsday, addressing some of the controversies surrounding the governor’s plan, which is said to be the first of its kind in the United States. With W. Hubert Keen (President of Farmingdale State College), The Rev. Calvin O. Butts, III (President of SUNY College at Old Westbury) and Shaun L. McKay (President of Suffolk County Community College), Stanley said, “Tax-Free NY offers a plan as innovative and exciting as the ideas it is designed to turn into economic growth,” the presidents continued. “We welcome the challenge it offers: Keep producing great innovations, and the state will help them grow and prosper on and near SUNY campuses.”

Barbara • Aug 27, 2013 at 10:23 am

Will SUNY employees pay state taxes? Or, are only the employees of the companies exempt?